The New York prompt pay provisions are a set of statutes that regulate timely payment on private and public projects. These statutes create default pay schedules and penalties for non-compliance. Furthermore, they apply to payments at every level of the construction payment chain. Let’s take a look at the specific regulations under the New York Prompt Payment Acts.

Table of Contents

![]()

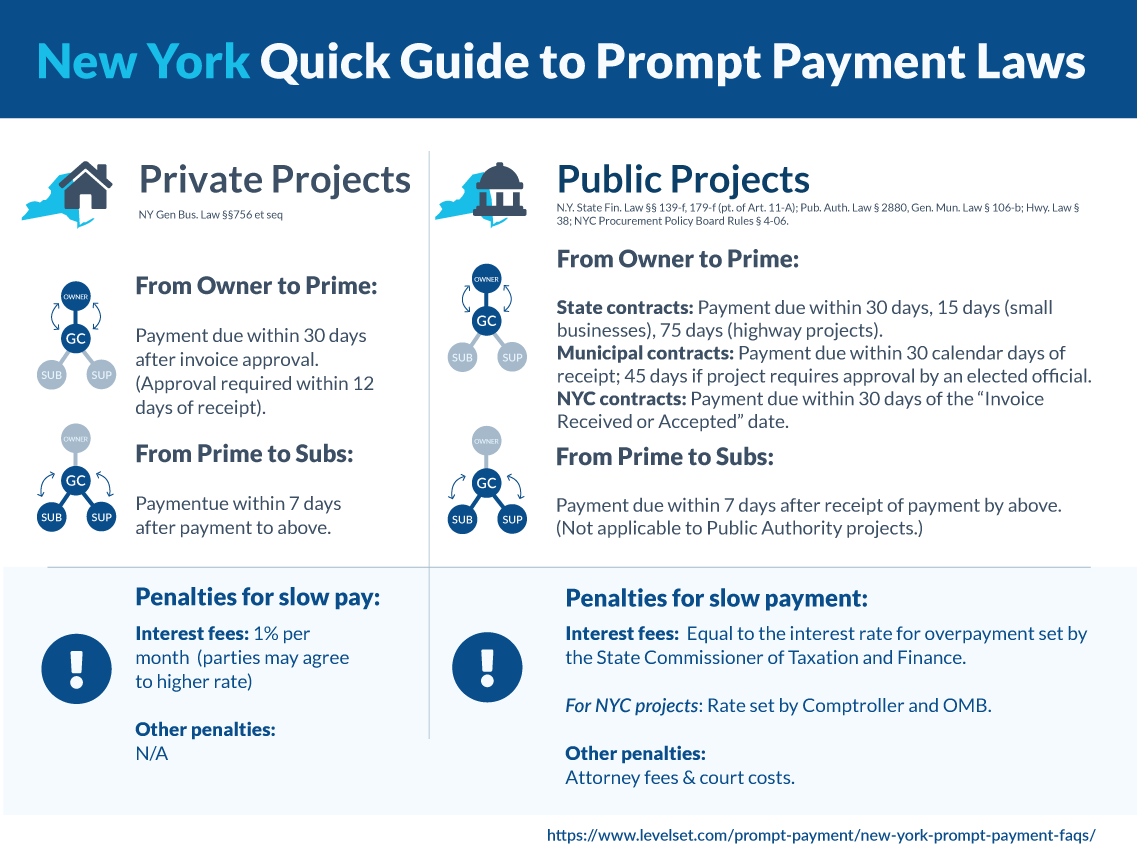

Payment on public projects is governed by a few different New York prompt pay provisions, depending on which governmental agency is commissioning the work. These statutes are the NY State Fin. Law §179-e to 179-p, the NY Gen Mun. Law §100 & 106(b), and the NY Pub. Auth. Law §2880.

The NY State Finance Laws cover projects commissioned by any state agency. NY General Municipal Laws cover projects entered into with political subdivisions such as municipal corporations, school districts, and boards of education. Lastly, the NY Public Authority Laws regulate payments on projects by “public authorities.”

*Note: The city of New York has its own unique set of rules that govern prompt pay; these will be covered in a future article.

For all public agencies and authorities, the general rule is that the public entity must promptly pay both progress and final payments within 30 days of receipt of a requisition or final invoice. These timeframes exclude any legal holidays. As for highway contracts, final payment must be paid within 75 days of receipt of an invoice.

Once payments are received by the general contractor, the clock for payment starts to tick. All payments made to the subcontractor and down must be made within 7 days of receipt of payment.

Under certain circumstances, the public agency may withhold payment past the statutorily prescribed deadlines. The statutes explicitly list the justifiable reasons.

State agencies

The statute governing state projects, list out a few reasons that payments can be validly withheld. Some of these reasons include:

Municipal agencies

Municipal agencies are authorized to withhold an amount necessary to satisfy any claims, liens, or judgments against the contractor that have not been discharged.

Public authorities

As for public authorities, the valid reasons for withholding payment are similar to those found under the state agency requirements. These include, but are not limited to; the necessary appropriation required to authorize payment has yet to be enacted, invoices that are required to be reviewed by the federal government, and authorized modifications to the contract payment terms.

For all types of public projects, any payments that are wrongfully withheld, are subject to an interest penalty. Interest will accrue on the unpaid amount at the rate equal to the overpayment rate set by the Commissioner of Taxation and Finance. These rates can be found on the Department website.

![]()

The New York prompt pay provisions governing private projects are found under the NY Gen. Bus. § §756 to 758. These provisions apply to all private projects with a contract price of $150,000 within the state, minus certain types of residential development projects. Furthermore, these payment provisions only apply to project participants below the sub-subcontractor tier.

For payments from the property owner to the general contractor. The clock begins to tick once a general contractor has submitted a proper invoice. The property owner must approve or deny the request within 12 days of receipt. If it’s determined that the invoice is improper, the owner must notify them of the reasons for denial, and the steps needed to be taken to correct the defective invoice or work. If there is no response within the 12 day period, this is considered a tacit/silent acceptance.

Once the invoice is approved, explicitly or tacitly, then payment must be made within 30 days of the approval. As for payments from the GC and subcontractors, payments are due to their subs and material suppliers within 7 days of receipt of payment from the higher-tier.

There is a specific list of circumstances in which payment can be withheld past the statutory timeframes. These include:

If payments are being withheld for any other reasons besides those provided above, the unpaid amount will be subject to penalization.

Any wrongfully withheld payments, the paying party will be penalized with an interest rate against the unpaid amount. Interest will accrue at a rate of 1% per month, or the interest rate specified in the contract; whichever is higher.

On private projects in New York, the statutes provide for the ability to stop work. If the owner fails to make timely payments, the GC fails to make timely payments, or if approvals or disapprovals are not made within the specified time limits. Suspension of work is possible only if certain notice procedures are followed.

If dealing with late payments or approvals, the contractor must provide the owner with written notice at least 10 calendar days before suspension of work. This notice should inform the owner of the disputed amounts and the intention to suspend performance. If all of these circumstances are present, the contractor can’t be deemed to be in breach of contract for suspension of work.

Send a Payment Demand. We're experts at prompting payment. It's fast, easy, and done right.

Given the nature of the construction industry, and the recurring issue of late payments on projects; state legislators have stepped in to help ensure timely payment. These deadlines are important to understand, as they affect not only a contractor’s right to payment, but their obligations to pass on payments. If you’ve performed work on a project and the timeframes for payment have passed since you’ve submitted an invoice, you might need to start taking some action. The New York prompt pay laws were enacted to ensure that everyone on a construction project within the state gets paid in a timely fashion.

The New York prompt pay provisions are a set of statutes that regulate timely payment on private and public projects. These statutes create default pay schedules and penalties for non-compliance. Furthermore, they apply to payments at every level of the construction payment chain. Let's take a look at the specific regulations under the New York Prompt Pay laws.